- #QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY HOW TO#

- #QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY SOFTWARE#

- #QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY PLUS#

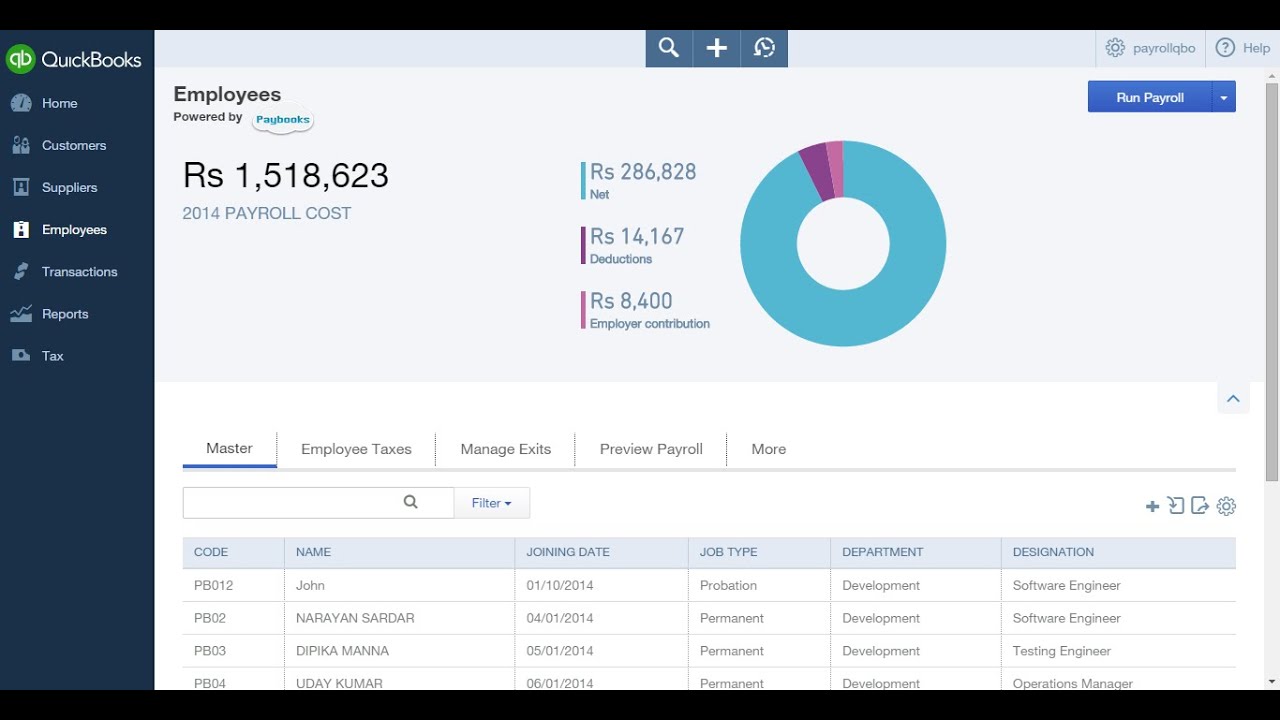

You’ll enter payroll hours, and QuickBooks will automatically calculate payroll checks and taxes for you. Now that you’ve got all of your employees set up, the next step is to run your payroll. The key is to make sure you complete and file both the payroll tax forms and payroll taxes by the due date. With each payroll that you run, QuickBooks calculates the amount of payroll taxes that you must remit on behalf of your business and your employees. RUN comes from ADP, a company that specializes in payroll and HR. As you can see, he doesn’t track employees at all since the payroll company does it all after they receive the total needed to pay everyone. I looked at it for a while in question, but their tax accountant seemed okay with it as the payroll company wrote their own checks to pay liabilities.

So they deduct 5,000 from his bank, pay the employees less the deductions that they then send off to pay taxes. I have a client that just enters the lump sum as ‘payroll expense’ which happens to be the gross wages. Those other platforms are nice, but remember QuickBooks controls some 80 percent of the market for small-business financial software.

#QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY SOFTWARE#

If you use ADP’s payroll services and QuickBooks accounting software, you can easily transfer your payroll data to your accounting software digitally. Manually entering data is a long, tedious process when you are doing the books for your small business, particularly if you have several payroll accounts.

#QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY HOW TO#

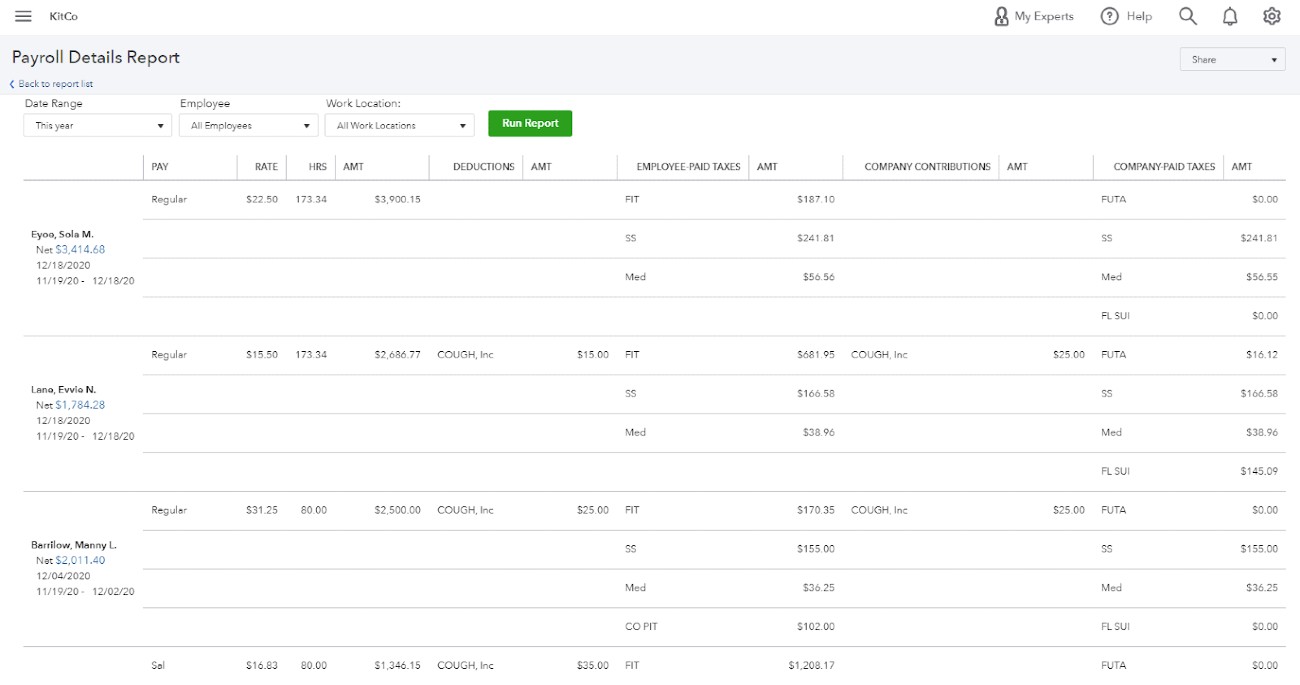

Tutorial 2: How To Customize Invoices, Sales Receipts & Estimates In Quickbooks Online You can access it from the same system you use to manage your business’ books, and your payroll expenses will easily transfer to the appropriate general ledger accounts. If you’re already using QuickBooks Online and you have employees, consider adding QuickBooks Payroll to your plan. This latest effort allows users to access complete GLI mapping through QuickBooks as well as “many other popular accounting software platforms,” ADP said. The point is to simplify the process of creating payroll journal entries and updating the general ledger after each payroll run. In ADP’s world, the online GLI converts payroll data to a general ledger file for import into a company’s accounting software. QuickBooks Payroll services include payroll checks or direct deposit, payroll tax payments, and all tax form filings.

#QUICKBOOKS DESKTOP PAYROLL RUN SUMMARY PLUS#

You can add payroll to your existing QuickBooks Online account for as little as $45 monthly plus $4 per employee, per month. Millions of business owners rely on QuickBooks Online for balancing the books, tracking inventory, and performing other tasks, including payroll. Let’s take a look at two of the big ones – RUN Powered by ADP, and QuickBooks Payroll.įortunately, making sure that your employees are paid on time every time is easier than ever with accounting software that boasts payroll capabilities. If you get payroll wrong, you’re in trouble not just with your employees, but with the state – which wants your payroll taxes! So payroll applications and payroll services need to be totally reliable. Paylocity Acquires Collaboration Platform Samepage.Tutorial 2: How To Customize Invoices, Sales Receipts & Estimates In Quickbooks Online.Time by Item: Shows the total time for each service item broken down by customer for a specified date range.Time by Name: Shows the time by person broken down by customer for a specified date range.Time by Job Detail: Shows the unbilled/billed/not billable time for each customer by activity for a specified date range.

Time by Job Summary: Shows the time for each customer broken down by service item for a specified date range.The following are a few reports available with QuickBooks Pro: The time tracking reports available may vary based on your version of QuickBooks. Go to the menu, select Reports > Jobs, Time & Mileage and then select the desired report. This feature works the same in versions 2011–2016 of QuickBooks. The following explains how to run a time tracking report. These reports are useful for confirming that all billable jobs have been invoiced to customers, for confirming the hours recorded, and for seeing the total hours spent for each customer. When you use either of the time tracking methods in QuickBooks, you can generate reports based on timed activities. How to Run a Time Tracking Report in QuickBooks

0 kommentar(er)

0 kommentar(er)